The Gold IRA Company

Matches Exceptional Investors with

Exceptional Investments

Blog

SILVER – TOP REASONS TO BUY NOW

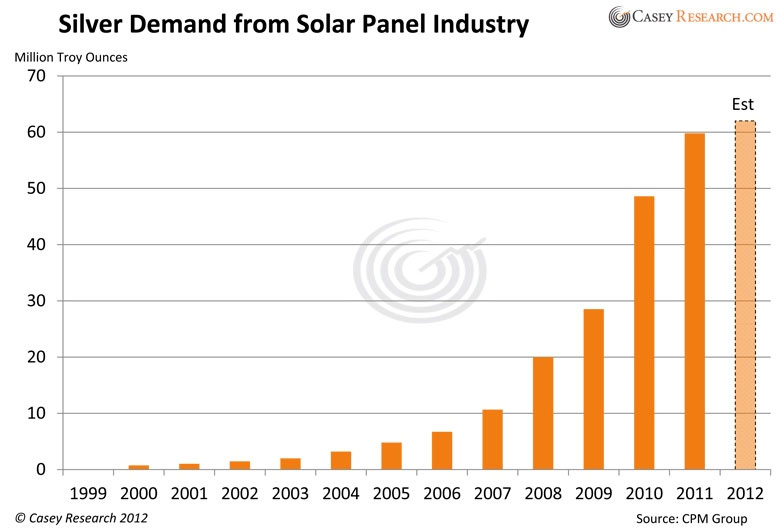

Exploding photovoltaic (solar) demand: According to Andrew Critchlow, Commodities editor for The Telegraph, silver is no longer the poor man’s gold as solar demand surges.

Other Industrial uses: In addition to its precious metal component, there is a heavy industrial demand including the medical and automotive industries due to its anti-microbial properties as well as being electronically and thermally conductive.

Silver has hundreds of industrial and medical applications and its usage is on the rise.

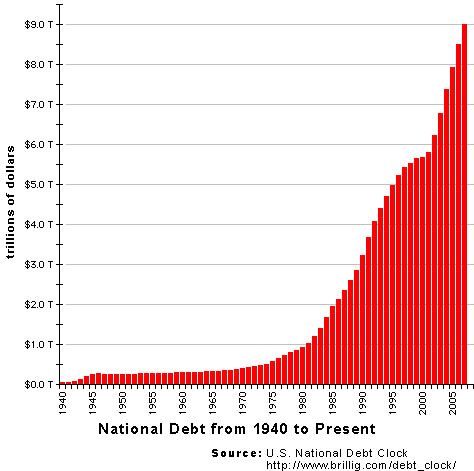

Easy money: Historically we have seen that as paper money is overprinted and loses its buying power, it takes more and more of those devalued paper dollars to buy the same things. This is often why the price of silver and gold rise as the value of paper money falls.

Inflation adjusted price: According to Zero Hedge, the silver price adjusted for both the CPI-U as calculated by the Bureau of Labor Statistics, and the price adjusted using ShadowStats data based on the CPI-U formula from 1980 (the formula has since been adjusted multiple times to keep the inflation number as low as possible.), the $48 peak in April 2011 was less than half the inflation-adjusted price of January 1980, based on the current CPI-U calculation.

If we use the 1980 formula to measure inflation, silver would need to top $470 to beat that peak. And, although that may never happen, even for silver to return to its 2011 high price of $48 affords many of today’s investors an excellent buying opportunity.

Market Correction Protection: All markets eventually correct excesses and imbalances. History repeats itself, and with the stock market at all time highs without the strong foundation of true corporate revenue supporting these unprecedented all time high levels, sooner or later there will be a correction in the paper markets.

Silver Production Costs: Relative to the cost of production, the price of silver today is still at a low level, which affects sustainability on a long-term basis. If a mine can’t operate profitably, the resulting drop in output would serve as a catalyst for higher prices.

Soaring national debt:

The Gold / Silver Ratio: Historically the gold silver ratio is 16 to 1, meaning that it takes 16 oz. of silver to buy one ounce of gold….with gold spot currently trading in the $1350 range, the price of silver should be trading around $84 oz. to be in the historic 16:1 price ratio to Gold. Another great indicator for investors to buy silver now!

We must prepare and balance our portfolios now. Call The Gold Ira Company today to speak with one of our precious metal specialists: 855-554-4853

References:

http://www.telegraph.co.uk/finance/commodities/11596319/Silver-no-longer-the-poor-mans-gold-as-solar-demand-surges.html

https://www.caseyresearch.com/articles/look-out-silver-here-comes-solar-demand

http://www.zerohedge.com/news/2014-08-14/guest-post-top-7-reasons-buy-silver-now