The Gold IRA Company

Matches Exceptional Investors with

Exceptional Investments

Blog

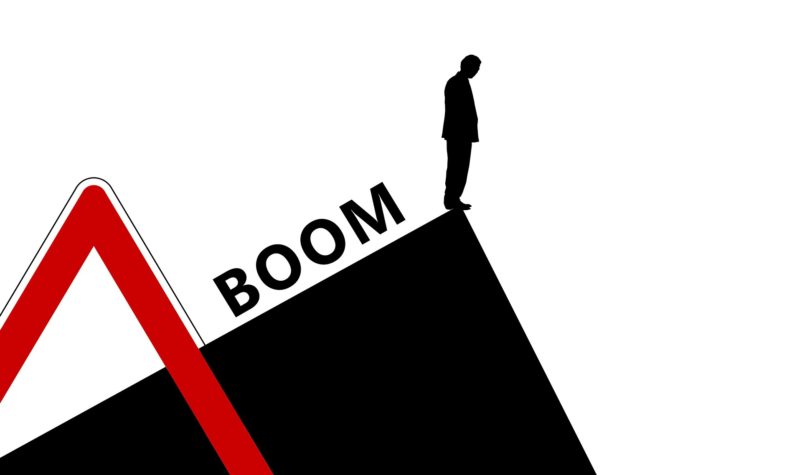

Market Watch: The S&P 500 is Now More Overvalued Than Ever, Per This Measure

Article by Chris Matthews in Market Watch

Wall Street strategists have been calling for fairly modest gains for U.S. stocks in 2020, with concerns over stock market valuations being commonly cited as a reason why investors should temper their expectations for equity returns in the coming quarters.

Indeed stocks are overvalued according to the popular measure of price-to-earnings (P/E) — which compares the price of one share of stock to one year of per-share earnings relative to recent history. The S&P 500 index is trading at 18.6 times forward earnings, according to FactSet data, above the average ratio of 16.7 during the past five years and 14.9 over the past ten.

But other, less scrutinized methods for valuing the stock market paint an even more stark picture.

The chart from Ned Davis Research, shows that price relative to sales for the S&P 500 is at a record high, “well in excess of what they were in 2000 or 2007 at those peaks,” wrote Ned Davis in a Wednesday note to clients.

Other measures, like the median price to earnings ratio — which exclude the skewed effects of very profitable and very unprofitable companies — shows the S&P 500 overvalued by nearly 30% versus the typical valuation level seen since 1964.

“But the S&P 500 could be overstating earnings due to buybacks and other financial engineering of profits,” Davis wrote, because corporate buybacks reduce shares in circulation, increasing earnings-per-share even if overall profits haven’t risen. Therefore, looking at the ratio of market valuations to overall profits suggests “P/E ratios are some 80% above the long-term norm,” Davis wrote.

To read this article in its entirety, click here.

Have Questions?

Speak to a Gold & Silver Specialist.

Call Now: 855-554-4853